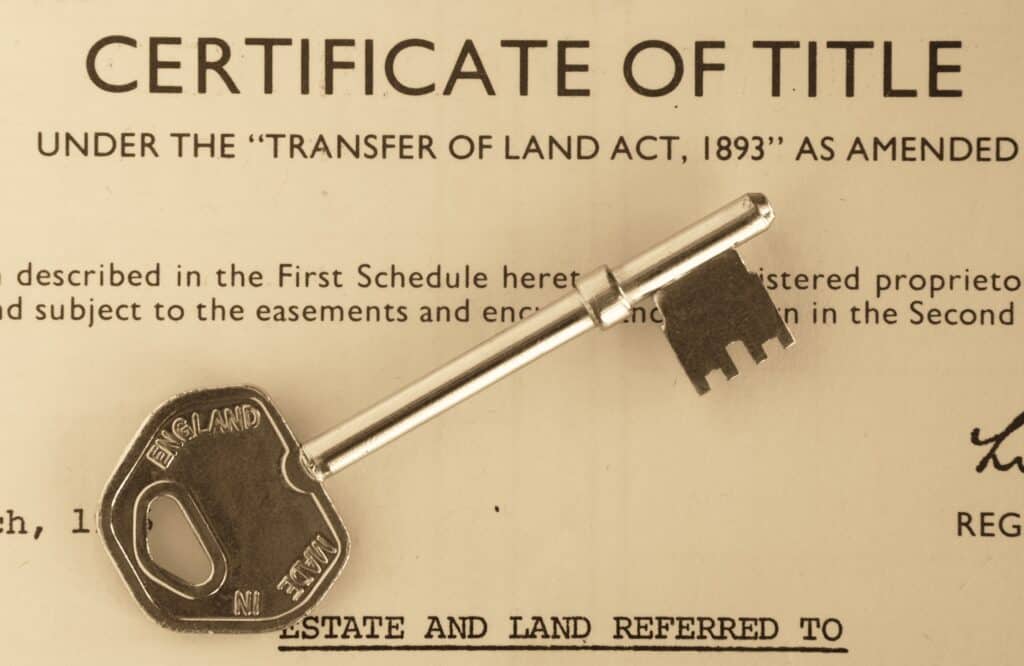

Buying a property is a significant investment and a complex process. One of the most crucial steps in this process is ensuring that the property’s title is clear and free of any liens, judgments, or other encumbrances that could impact the transfer of ownership. This is where a title commitment comes in. A title commitment is a document that outlines the conditions that must be met before the title to a property can be transferred to a new owner. One of the most important sections of the title commitment is Schedule B. In this blog post, we will explore the Schedule B on a title commitment and why it is essential to review before closing on a property.

What is a title commitment?

A title commitment is a document that outlines the conditions that must be met before the title to a property can be transferred to a new owner. The document is typically produced by a title company, which is a third-party service provider that specializes in researching and issuing title insurance. Title insurance protects the buyer from any legal disputes that may arise from title issues.

The title commitment contains information about the property’s legal description, the current owner, and any conditions that must be met before the title can be transferred. These conditions may include the resolution of any liens, judgments, or other encumbrances that could impact the title. The title commitment is an essential part of the property buying process, as it provides assurance that the property’s title is clear and free of any issues that could impact the transfer of ownership.

What is Schedule B?

Schedule B is a section of the title commitment that lists any conditions that must be met before the transfer of the title can occur. It includes any liens, judgments, easements, or other encumbrances that may impact the property’s ownership. Schedule B is divided into two sections: Schedule B-1 and Schedule B-2.

Schedule B-1 contains requirements that must be met before the transfer of the title can occur. These requirements typically include the resolution of any liens, judgments, or other encumbrances that could impact the title. For example, if there is a mortgage on the property, it must be paid off before the title can be transferred to the new owner.

Schedule B-2 contains information about the property that may impact the title but does not require resolution before the transfer of the title. For example, if there is an easement on the property, it may be listed in Schedule B-2, but it does not necessarily need to be resolved before the title can be transferred.

Why is it important to review Schedule B?

Reviewing Schedule B is a critical step in the property buying process. It helps ensure that you are buying a property with a clear title and prevents any surprises or complications down the line. By carefully reviewing Schedule B, you can identify any issues that need to be addressed before closing. If you do not review Schedule B carefully, you may be unaware of any issues that could impact the transfer of the title.

Some common issues that may appear on Schedule B include:

- Liens: A lien is a legal claim against the property that may impact the transfer of the title. A lien could be placed on the property if the owner owes money to a creditor or has not paid property taxes. If a lien is listed on Schedule B, it must be resolved before the transfer of the title can occur. This may involve paying off the debt or negotiating with the creditor to release the lien.

- Judgments: A judgment is a ruling in a lawsuit that may impact the title to the property. If the previous owner was involved in a lawsuit, and the judgment was against them, it could impact the transfer of the title. For example, if a contractor filed a lawsuit against the previous owner for unpaid work, and a judgment was entered against the previous owner, the contractor may have a lien on the property, which must be resolved before the transfer of the title.

- Easements: An easement is a right granted to someone else to use the property for a specific purpose. For example, a neighbor may have an easement to access their property through a driveway on the subject property. Easements are listed on Schedule B-2, and while they may not require resolution before the transfer of the title, they could impact the new owner’s use of the property.

- Encroachments: An encroachment occurs when a part of the property, such as a fence or a building, extends over a boundary line onto a neighboring property. Encroachments may result in disputes with the neighboring property owner and may need to be resolved before the transfer of the title.

- Covenants, conditions, and restrictions: Covenants, conditions, and restrictions (CC&Rs) are limitations on the use of the property. For example, there may be CC&Rs that prohibit the construction of certain types of buildings on the property. These restrictions may impact the new owner’s use of the property and should be reviewed carefully before closing.

It is important to review Schedule B carefully with your real estate agent, attorney, or title company to identify any issues that need to be resolved before closing. The resolution of these issues may require negotiations with creditors, a legal dispute, or other actions that can take time and delay the closing process. By identifying these issues early on, you can avoid surprises and ensure that the property’s title is clear and free of any encumbrances.

In some cases, the title company may issue a “clean” title commitment, which means that there are no liens, judgments, or other encumbrances on the property. While this is ideal, it is still important to review Schedule B carefully to ensure that there are no easements or other restrictions that could impact the new owner’s use of the property.

In summary, Schedule B is a critical part of the title commitment that must be reviewed carefully before closing on a property. It lists any conditions that must be met before the transfer of the title can occur, including liens, judgments, easements, encroachments, and CC&Rs. By reviewing Schedule B carefully, you can identify any issues that need to be resolved before closing, avoid surprises, and ensure that the property’s title is clear and free of any encumbrances. This is a crucial step in the property buying process and can help protect your investment in the long run.